Mobile phone installment purchase is an increasingly popular method for those who wish to upgrade their smartphone and stay up-to-date with the latest models. For individuals experiencing a tight cash flow, purchasing a phone through phone loans can be an attractive option. In the present day, there are numerous options available for buying, leasing, or renting smartphones.

Contents

These options include:

1. Phone instalment purchase, including:

- Buy now, pay later;

- Cellphone manufacturer financing; and

- Retail smartphone financing; as well as

2. Leasing, including;

- iPhone leasing; and

- Samsung Galaxy leasing.

Each of these options provides distinct benefits, and consumers can choose the one that best suits their needs and budget. Through cell phone manufacturers such as Samsung and Apple, customers can lease their smartphones for a fixed period, pay a monthly fee and upgrade to the latest model after the lease term expires. Mobile service providers, such as Globe and Verizon, offer deals that cater to specific budgets and provide additional perks based on the customer’s preference and smartphone package. Additionally, leasing platforms provide another alternative to financing or purchasing phones in installments, allowing individuals to use a smartphone for a set time and then return it when the time limit is exhausted.

Phone installment purchase

This particular option affords an individual the ability to remunerate sums of money over a period of time by providing a specified amount of initial payment. The specifics of the financial agreement relating to telephone installment payments vary depending on the purchasing location and the amount of the down payment provided. In certain instances, the financing terms can extend for a duration of up to two to three years. As a requisite for eligibility to purchase a phone via installment payments, various institutions, including financial institutions and telecommunication networks, frequently perform credit assessments.

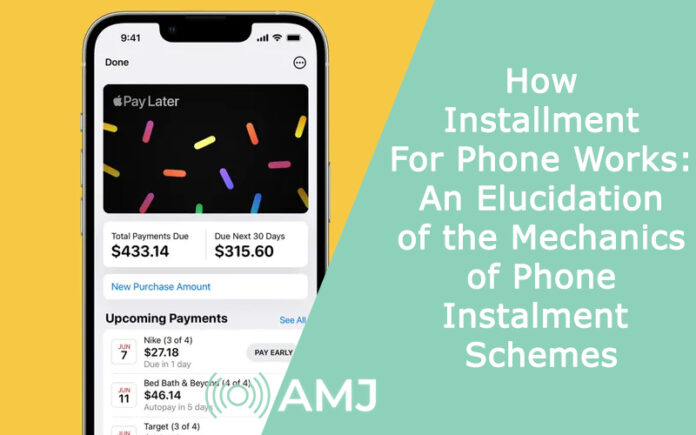

Buy now, pay later

This form of installment financing provides an avenue for purchasing items through an initial down payment followed by four or more subsequent payments. By opting for this payment plan, one could potentially save money due to the absence of fixed fees or interest rates on certain services. It is important to note, however, that not all cellphone and telecommunications companies engage with buy now, pay later platforms, and as such, one should confirm if the option is available prior to making a purchase.

Cellphone manufacturer financing

Both Samsung and Apple offer financing options for their respective brands of mobile phones. In order to participate in Samsung’s financing program, one must first pass a thorough process of identity verification. Once this has been successfully completed, the customer is then able to select their preferred smartphone model and proceed with the financing process. As part of the financing process, the customer is required to pay a security deposit in order to lease the smartphone on a Monthly Rental Installment basis. This payment scheme allows the customer to spread out the cost of the smartphone over several months, making it more accessible to a wider range of customers. Samsung’s financing program is a convenient option for those who are unable or unwilling to make an upfront payment for the full cost of the phone.

Retail smartphone financing

There is an additional option available for those who seek to finance a smartphone, which is through their cell phone service provider. Notably, Globe and Verizon are two such providers that offer a range of attractive deals to customers seeking to acquire smartphones. These deals cater to specific budgets, thereby enabling customers to select a smartphone package that best suits their financial position. In addition to the attractive pricing, there are also additional perks that are included in the various packages, providing customers with more value for their money.

Leasing

Leasing offers an alternative to purchasing smartphones either through financing or installments. This method entails using the smartphone for a fixed period, after which it is returned. While leasing, a predetermined fixed leasing amount is paid on a regular basis – either monthly, biweekly, or weekly. It is a cost-effective means of obtaining a smartphone as it is usually cheaper than outright purchase. Additionally, with every release, one can easily upgrade to the latest version of the smartphone.

iPhone leasing

In the realm of smartphone leasing, iPhone offers its customers the opportunity to lease their phones for a minimum of 12 months. The company offers two financing options – fair market value and $1 buyout. In order to qualify for iPhone’s leasing program, the minimum purchase order must be at least $4000, and customers are able to finance up to 25% of that amount. The fair market value financing option involves a payment structure in which customers pay for the use of the device during the leasing period. At the end of the lease, customers have the option to either return the phone or upgrade to a new device, with the cost of upgrading rolled into a new lease agreement. The $1 buyout financing option allows customers to own the device at the end of the lease period by making a final payment of $1. This option is best suited for customers who want to own their device after the leasing period, rather than continually upgrading to a new device. It is important to note that both financing options require customers to have good credit scores and to pass credit checks. In addition, customers who opt for the leasing program must return the device in good condition, or risk being charged additional fees for damage.

Samsung Galaxy leasing

The process of leasing a Samsung smartphone is a simple and convenient way to acquire one of their state-of-the-art devices. It requires a straightforward identity verification process prior to selecting the preferred smartphone model, followed by the provision of a security amount to lease the device on a Rental Monthly Installment basis. When you lease a Samsung smartphone, you are granted an interest-free Annual Percentage Rate (APR) for a time period of 24 months. This implies that you will not be required to pay any additional charges or interest fees during this time period. Furthermore, if the mobile phone is in good condition, you will be given the opportunity to exchange it for a new Samsung phone after 12 months. Overall, leasing is an attractive option that Samsung provides to their customers, and it offers a practical way to acquire a cutting-edge device.

In conclusion, financing, leasing, and renting smartphones have become popular and convenient options for people who want to upgrade their mobile devices but have limited cash flow. With various options available, individuals can choose the best fit for their budget and preferences. It is important to carefully consider the terms and conditions of the financing agreement before committing to ensure that it is feasible in the long run. As technology continues to advance, it is likely that mobile phone installment purchase will continue to be an integral part of both lifestyle and work.

![Index of Money Heist [Season 1, 2, 3 & 4 – All Episodes, Cast and Plot] Index of Money Heist](https://www.asiamediajournal.com/wp-content/uploads/2021/05/Index-of-Money-Heist-3-100x70.jpg)